Our Frost Pllc PDFs

Table of ContentsHow Frost Pllc can Save You Time, Stress, and Money.Rumored Buzz on Frost PllcSee This Report on Frost PllcFrost Pllc Fundamentals Explained4 Simple Techniques For Frost PllcGet This Report on Frost PllcAn Unbiased View of Frost Pllc

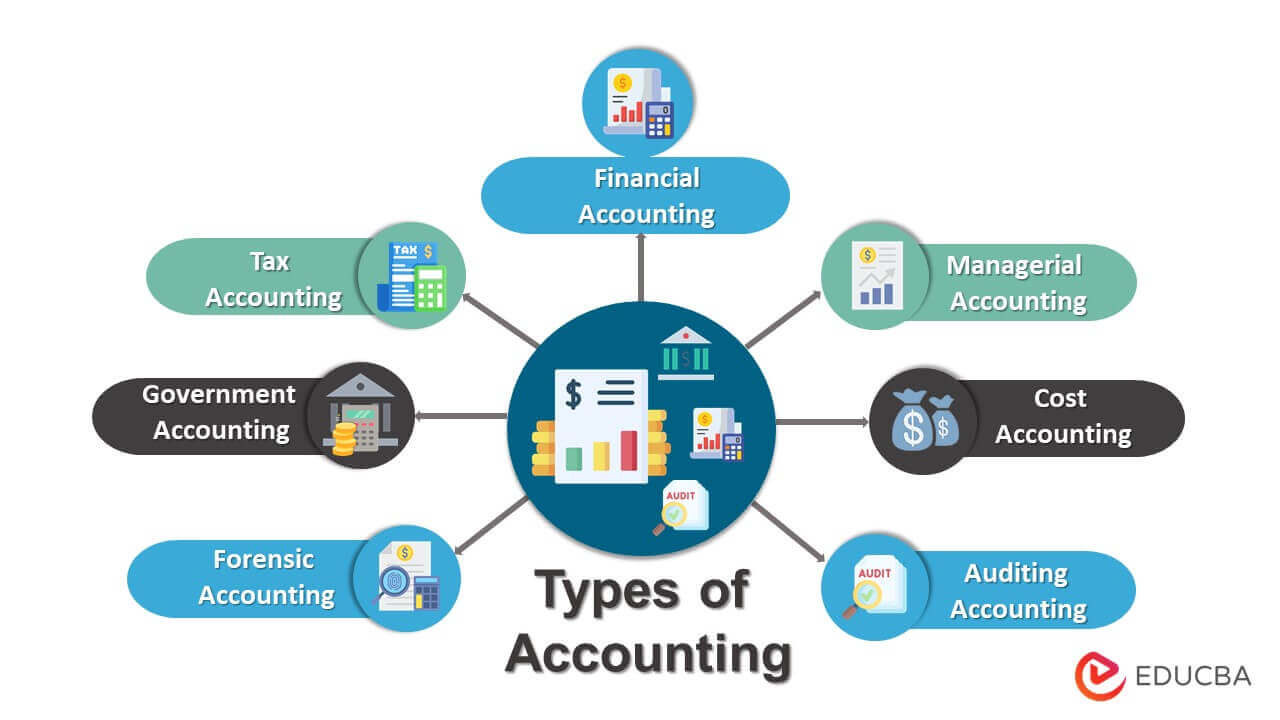

Federal government accountancy entails audit solutions for federal government entities. The accounting professional ensures that expenses and earnings are by the regulation. They are additionally in charge of taking care of federal government properties and creating a budget plan. They accountant record and examine business economic information and utilize the info to assist in budgeting, expense monitoring, asset management, and efficiency evaluation (Frost PLLC).They check if the service is working by the regulation and regulation. The accountants can focus on numerous fields of bookkeeping, consisting of, environmental bookkeeping, innovation auditing, and conformity bookkeeping. 1. Bookkeeping2. Tax accounting3. Chartered accounting4. Forensic accounting5. Financial controller services6. Audit audit7. Bank reconciliation8. Account payable9. Account receivable10. Pay-roll processingThis type of accounting solution entails maintaining records of the financial accounts of business.

The bookkeeper checks the settlement of the accounts and just how they are received. This manages revenue tax and various other tax obligations that are positioned on business. The tax accounting professional guarantees that they give the most effective suggestions when it concerns cases and safeguards the business from paying unnecessary tax obligations.

Some Of Frost Pllc

The economic controllers are the head of the commercial department. Their job consists of; designating work to employees, overseeing staff, and managing new clients. They may likewise carry both exterior and inner bookkeeping tasks. They make certain reliable and accurate accounting job. Auditing offers detailed monetary details regarding the company. The auditors are involved validating and guaranteeing the accuracy of economic declarations and records.

This solution makes certain accurate accounting of monetary records and helps to find any type of discrepancy.the accounting professionals aid in supplying the company lower costs and shield fraudulence. This solution makes certain precision in tax obligation rates and regulatory info. It gives the upkeep of monetary documents of worker's revenue, reductions, and perks.

Accounting solutions have to conform with the legislations and guidelines of the firm along with those of the state.

Not known Facts About Frost Pllc

If you have a go to numbers and a heart for aiding services operate with accuracy, becoming an accounting professional can amount to a pleasing and beneficial profession. Broadly talking, accountants are specialists that assess and report on financial transactions for people or services. There are lots of kinds of accounting professionals, covering all kind of sectors consisting of the public field, nonprofits, personal industry, and regional, state, and federal government.

Let's dive in and see which kind of task in this sector rate of interests you the most! Monetary accounting is one of the most well-known types of accountants, that are commonly liable for preparing monetary declarations for their customers.

The Frost Pllc Statements

Certified public accountants are one of the types of accountants that are nearly generally required and essential for an effective organization. As its relative stability no matter what the economic climate, tax obligations must be submitted.

However, CPAs click now are licensed and might have various other qualifications as well. Tax accounting professionals are accountable for aiding clients tackle a number of tax-related needs outside of filing quarterly or yearly taxes, consisting of helping with audit disagreements, licensure, and extra. Credit supervisors assist determine whether a business or person can open up or extend a credit line or a finance.

The Frost Pllc Ideas

Credit history managers can likewise function inside to assist a company collect repayments, problem credit reports or loans, and examine the firm's economic threat. By establishing a business's budget, price accountants aid guide decision-making and spending control. This duty resembles much of the various other kinds of accountants formerly pointed out, in that they have a number of obligations when it concerns numbers: auditing, reporting, examining, and more.

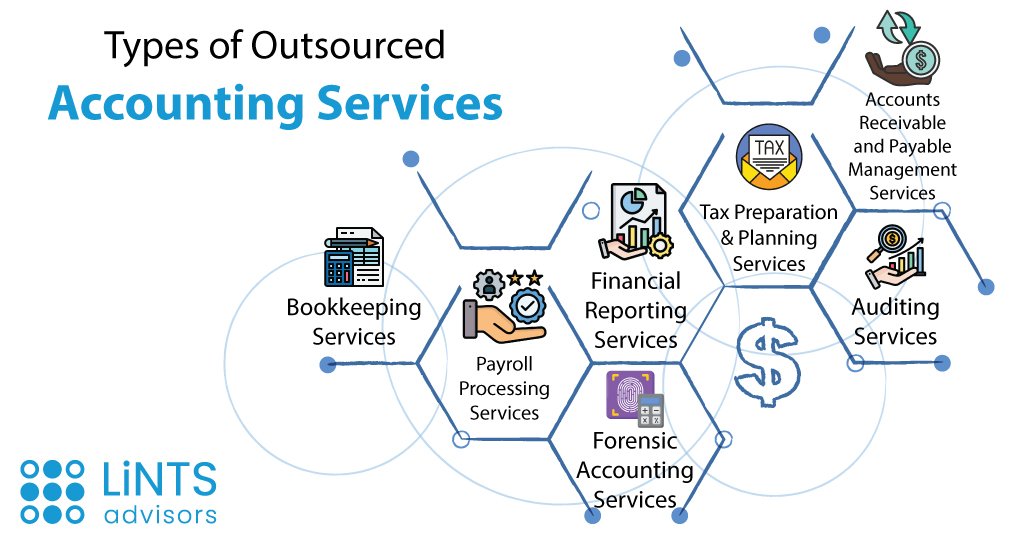

Customer Bookkeeping Provider (CAS or CAAS) refers to a vast array of conformity and advisory solutions an accountancy company offers to an organization customer. Basically, the accounting firm serves as a contracted out financing department for the client. Service owners are proactively seeking ways to achieve even more development with less job, time, and labor force.

You'll likewise find CAS referred to as CAAS, Client Accounting Advisory Providers, or Client Advisory Providers. Right here are some of the key rates of CAS: Accounting is a fundamental rate of CAS.By assisting customers with the daily recording of financial purchases, you create the building blocks of their financial documents, aid in conformity, and provide the necessary information for tactical decision-making.

Consists of inbound repayments, billing development, tracking payments due, taking care of collections, and ensuring that the client's money flow is constant and predictable. Makes certain that all organization purchases are precisely tape-recorded, making certain the integrity of economic data. Frost PLLC.

Get This Report about Frost Pllc

Audits and tax preparation are standard services, but they remain important to detailed CAS offerings. Audits include taking a look at a business's economic statements and documents to make sure accuracy and conformity with accountancy check my blog requirements and guidelines. In addition, tax obligation preparation entails assembling and submitting tax obligation returns, ensuring accuracy to stay clear of penalties, and suggesting on tax-efficient methods.

Generally, invoicing by the hour has been the go-to technique in accounting. Firms determine a hourly rate based on repaired prices and a targeted profit margin. Theoretically, it's a straightforward approach: you do the work, the clock ticks, the bill expands. But this design is becoming progressively obsolete in today's accountancy landscape.

It's comparable to a fixed-priced version because you charge in different ways relying on the solution, however it's not a one-size-fits-all technique. It involves specific discussions with your clients to establish what their concerns are, what solutions they need, exactly how usually, and the scope of the jobs. From there, you can consider up all of these factors and provide a quote that properly shows the effort, time, and job called for to meet their requirements.

Frost Pllc - Truths

Anything you can do to assist your client, you do it. And when you can not, you facilitate their connection with a customized company. It's a premium version: a costs level of solution and a premium cost. It rates your connection with your client, rather than inputs or outputs. You might bill a client $7,500 per month, which includes all the services you supply.